IE C&E 1076 2019-2026 free printable template

Show details

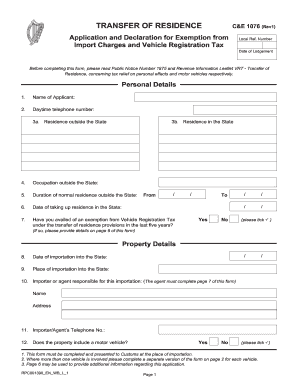

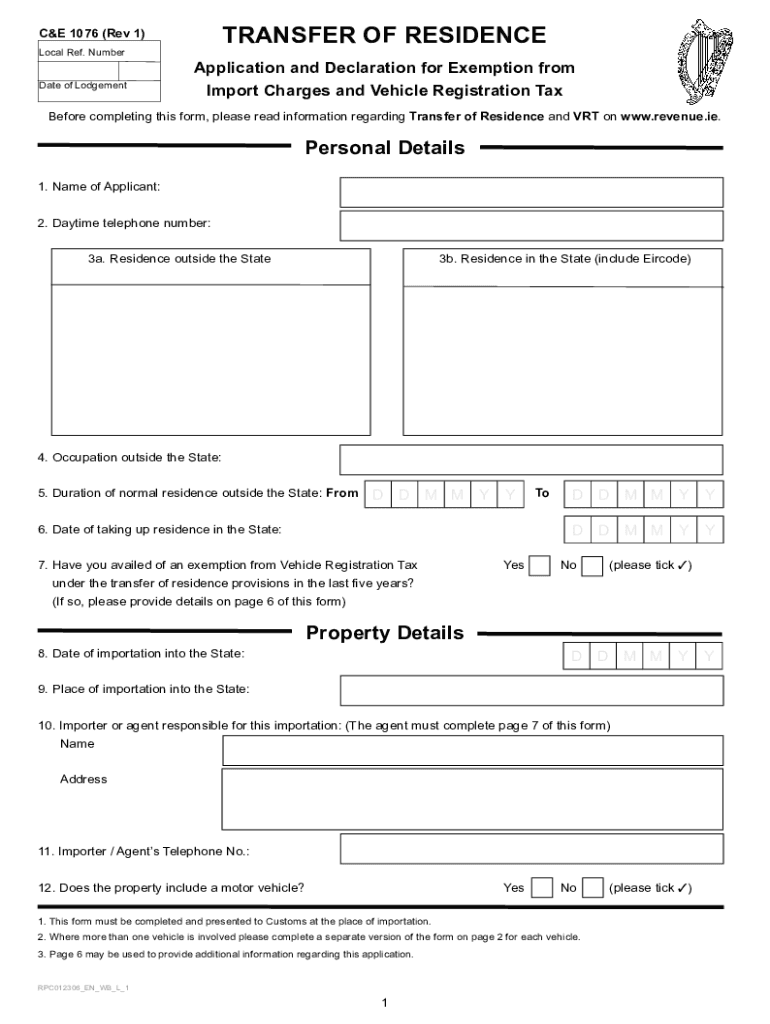

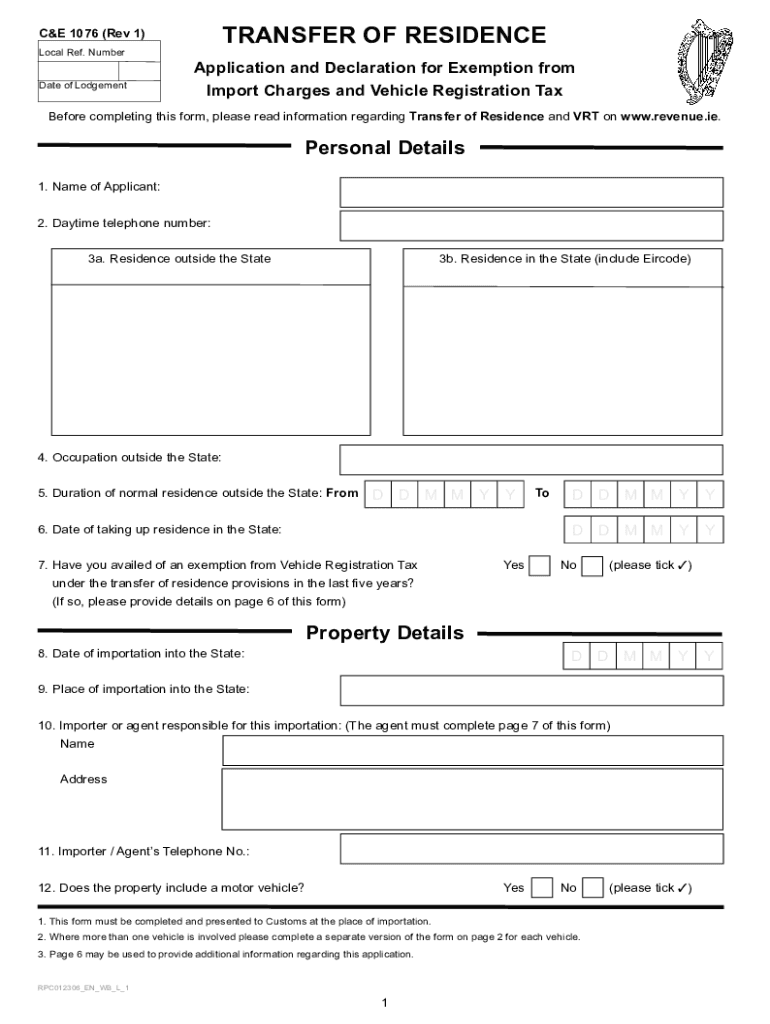

Application and Declaration for Exemption from Import Charges and Vehicle Registration Tax related to the transfer of residence to the State.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign people also ask about ie transfer of residence in ireland form

Edit your form 1076 transfer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ireland transfer residence form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdffiller online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ireland transfer residence form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IE C&E 1076 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out c e 1076 form

How to fill out IE C&E 1076

01

Begin by downloading the IE C&E 1076 form from the official website.

02

Fill in your personal details including name, address, and contact information in the designated sections.

03

Provide accurate information regarding the goods being imported, including descriptions and value.

04

Indicate the nature of the import and any applicable duties and taxes.

05

Review your entries for accuracy and completeness before submission.

06

Submit the completed form through the appropriate channels specified by the relevant authority.

Who needs IE C&E 1076?

01

Individuals and businesses importing goods into the country who need to declare these imports for customs purposes.

Fill

1076 form

: Try Risk Free

People Also Ask about ireland transfer of residence form

What is transfer of residence?

Transfer of Residence is a facility provided to persons who intend to transfer their residence to India after a stay abroad of at least two years. This facility allows the import personal and household articles, free of duty and certain other listed items, on payment of a concessional rate of duty.

Who is exempt from VRT in Ireland?

Persons established outside the State Revenue may grant a vehicle temporary exemption from the requirement to register in the State if it is: both taxed and registered abroad. owned or registered abroad by a person established outside the State. not disposed of or hired out or lent to a person established in the State.

What is a tor1?

Use this form to apply for transfer of residence (ToR) relief when moving or returning to the UK.

What is the transfer of residence form from UK to Ireland?

You must submit a transfer of residence form C & E 1076 (pdf) to Revenue two weeks before your goods arrive. You can claim relief from import tax by submitting this form. You don't need to include toiletries, used clothing or accessories on the form.

What are the rules for transfer of residence in Ireland?

be your personal property. have been in your possession and used by you for at least six months before transfer of residence. Any possession and use in the State, even during times when you were living abroad, does not count. brought into the State within 12 months of the date of your transfer of residence.

What is a UK transfer of residence?

Transfer of residence relief Transfer of residence ( ToR ) relief is available when you: transfer your normal place of residence — it allows you to import your goods, including animals and means of transport, with relief from import duties and charges. are a student coming for full-time study.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send transfer of residence from uk to ireland form for eSignature?

When your ireland customs declaration form pdf is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit form 1076 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing transfer of residence ireland and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my transfer of residence from uk to ireland in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your transfer of residence form ireland directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is IE C&E 1076?

IE C&E 1076 is a customs form used in international trade to report and document the movement and valuation of goods when importing or exporting.

Who is required to file IE C&E 1076?

Any individual or business that engages in the import or export of goods must file IE C&E 1076 as part of their customs compliance.

How to fill out IE C&E 1076?

To fill out IE C&E 1076, provide accurate information regarding the goods, including descriptions, quantities, values, and any applicable tariffs, then submit the completed form to the relevant customs authority.

What is the purpose of IE C&E 1076?

The purpose of IE C&E 1076 is to ensure proper documentation and compliance with customs regulations, facilitating the legal movement of goods across borders.

What information must be reported on IE C&E 1076?

The IE C&E 1076 must report information such as item descriptions, quantities, values, consignee and consignor details, and any relevant declarations or certifications required by customs.

Fill out your IE CE 1076 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1076 is not the form you're looking for?Search for another form here.

Keywords relevant to c e registration

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.